I get a lot of comments from people when I tell them I’m leaving my job to follow a dream. The first is “I didn’t know you were that good,” which I have some thoughts about here. The second has to do with how I can afford to not work for a year. This post will share what I did to prepare for my life change, and while this example is unique to me, everyone can find ways to lower expenses.

But first, a thought experiment: A dollar is always a dollar

Let’s say you just bought a soda for $1 from a store 10 minutes away. When you get home, you realize that they charged you $11 instead of $1. Do you go back to the store to ask for your $10 back?

Now let’s say you just bought a car from a dealership 10 minutes away for $40,000. When you get home, you realize they tacked on a $10 service fee that they hadn’t told you about. Do you go back to the dealer to ask for the $10 back?

Most people would go back for the soda but not for the car because of the relative size of the injustice. But at the end of the day both situations leave you with the same question. Do you want an extra $10 in your pocket?

So how do you get ready to give up your income for a year?

I didn’t just decide to leave my job to pursue a dream. I started pursuing the dream while I still had my job. Eventually, it got to the point where I needed to make a bigger commitment than my job allowed, and at that point I had already changed my spending habits to reduce my expenses.

My cost cutting goal

My goal was to change as few habits as possible while maximizing my reduction in expenses. I didn’t want to have to make dozens of mildly painful decisions to not buy something that I wanted. I planned to make just a couple of changes that would have a big impact. (Check out Dollars and Sense by Dan Ariely for a great read about how we misthink about money if you’re curious about what guided my logic).

Planning

A few years ago I had a master suite (with 2 roommates) in a new apartment building on 14th street, was single and went out a lot, and went on a lot of trips. I said “yes” to everything, which resulted in a very exciting life, but also an expensive one.

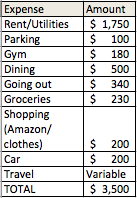

My monthly expenses, not including trips, were between $3,000 and $3,500 per month. Saving $1.50 on eggs by going to Safeway instead of Whole Foods was not going to make a difference.

Changing spending habits

Now, a lot of people will tell you that this is the time to skip the guac at chipotle, clip coupons for the grocery store, and start shopping at Marshalls.

While these will allow you to save for smaller purchases like new Allbirds, they won’t give you the freedom to make a big life change.

Look at it this way. You can save $2.50 each time you skip guac at Chipotle. If you have 8 visits, that saves $20. But, you didn’t get to enjoy the guac, and you had to make the slightly painful decision to skip it on 8 separate occasions!

What would be an easier, faster, and less painful way to save $20 over the course of a month?

I was going out about twice each week, or 8 times each month. If you’re with 1 friend or on a date, each round of drinks is about $20. Deciding to not buy that additional round just 1 time saves $20 with a single decision. If you skip it all 8 times, thats a total of $160 of savings each month. You can even skip the bar entirely and grab a 6-pack instead. But there are better ways to cut costs!

Lower your expenses by focusing on the biggest impact

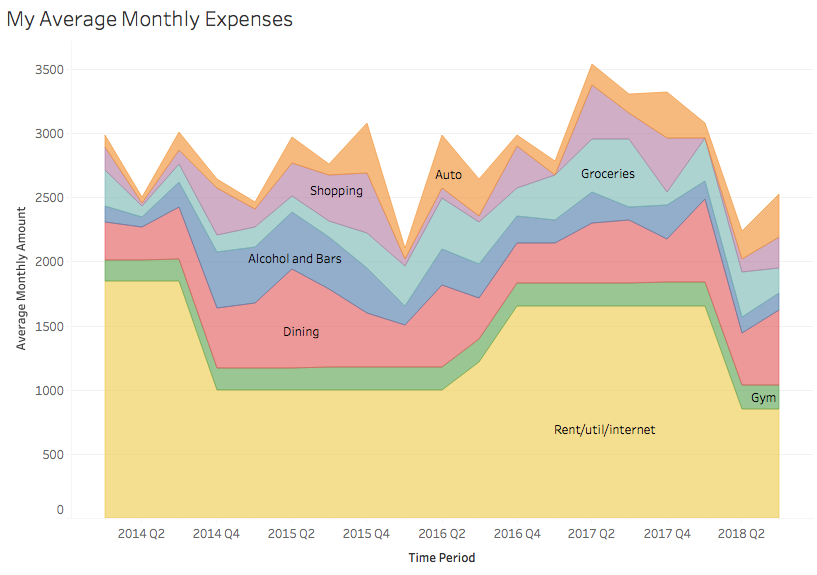

In April 2018 I moved into a 470 square foot studio with my girlfriend, Michelle, and her cat, Tucker. This brought my rent/utilities/parking total down from $1,850 per month to $850 per month. That single decision saved me $1,000 per month! That’s the same as:

- guac 400 times

- a round of drinks 50 times

- a $200 dinner 5 times

- a round trip international flight

- rent and utilities for a month while I am not working

You can see below that the driving factor for my overall spending is lowering my biggest expenses, which is rent/utilities/internet. Making a significant dent in any other category would take a lot of effort, and for me, wouldn’t have the same impact as significantly lowering my rent. For you it might be rent, but it could also be a car, club or gym membership, or something else (I did make additional lifestyle changes which you can see below).

How to lower rent without moving in with your significant other

Not everyone can or should move in with a significant other (THIS SHOULD NEVER BE A FINANCIAL DECISION!). Michelle and I were going to move in together at this point in the relationship, but we decided that I would move into her small apartment, rather than move into a larger/more expensive one.

You can usually find less expensive living accommodations if you’re willing to make some sacrifices. When I first moved to DC I was paying about $1,900 per month, which I quickly realized was way too much. At the end of that lease I moved in with 2 friends and my new rent/utilities were about $900 per month. I was still in a good location with a doorman, and had a roof with grills, tv’s, a pool, and a hot tub. BUT I slept in a fake room with poor airflow and had to walk through my roommate’s room to use the bathroom (thank you Bradley!). Nobody chooses to live like that, but it saved me $1,000 per month!

The bottom line here is you should be open to living with roommates, moving to a less convenient location, living in an older building, or taking the fake bedroom if you want to put a real dent in your rent.

Summary and takeaways

Before I decided to try to be a golfer I toyed with the ideas of traveling for a year or trying to start a business. While the purpose of leaving work would have been different, the planning and action that I took is largely the same and can be a template for anyone who wants to cut costs to travel, start a business, or even have a mini-retirement.

Going back to the thought experiment, fighting for $20 off your monthly rent is the same as getting a $40 scarf for 50% off. $20 doesn’t seem like a lot when it’s a part of your rent, but it’s still $20 dollars, Don’t forget that!

If you get anything out of this post, let it be the following:

- Determine your largest costs and how you can cut them

- Try to exhibit self control when it isn’t painful

- Get the guac

Additional lifestyle changes

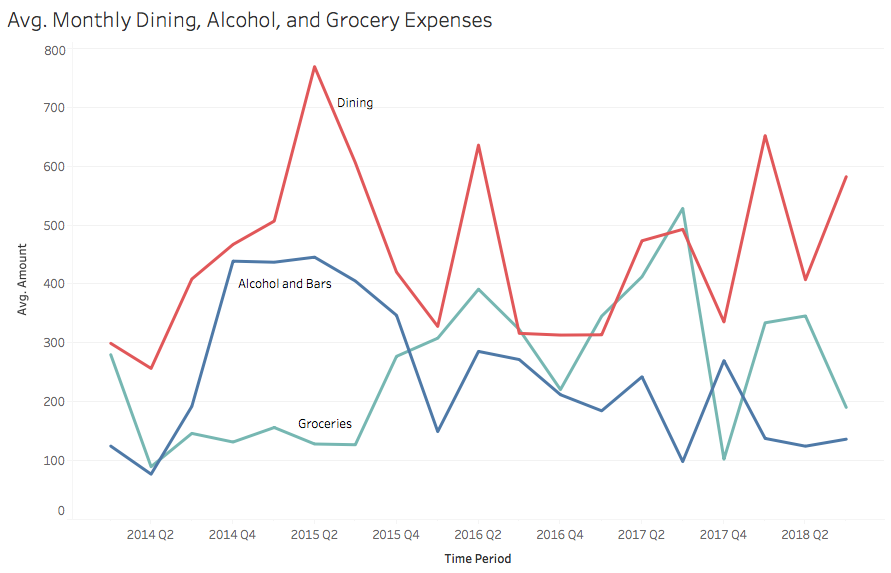

My other major lifestyle change was to go out less and cook more. I went out less because I had a girlfriend and a great group of friends, so I wasn’t trying to meet people like when I first moved to DC or when I was single.

Below, you can see that my alcohol and bars expenses have been going down for years, while groceries have been creeping up slightly.

How to display your expenses like I did above

- Sign up for Mint.com and link your credit card/bank accounts.

- Go to the “trends” tab and select the largest category.

- Sort the expenses from largest to smallest.

- Check the expense category for the largest expenses to make sure Mint.com allocated the expense to the correct category – I’ve had a restaurant show up as an auto expense.

- If you find an expense that is allocated incorrectly, click “edit details,” and create a rule to allocate all similar expenses to the correct category so you only have to make the change once.

- Do this for the other categories until you’re comfortable that the largest expenses are all properly allocated. There’s no need to correct the small expenses because they won’t make a difference with the overall trends and it will take a lot of time.

- Go to the trends “over time” and filter by category. You can export the data to excel and make graphs there if you like.

- I used Tableau Public to create these graphs. You can sign up for free here.